Fraudsters are stealing people's money via Cash App scams, raising questions about how secure this contactless payment app really is

13 Common Cash App Scams & Hacks: How to Stay Safe

Money-transfer apps like Cash App have grown in popularity, allowing users to instantly send and receive money. But Cash App scams are rising too. Recently, Cash App was ordered to pay $255 million in penalties after federal regulators found the company had “woefully incomplete” customer protections, making it nearly impossible for fraud victims to recover their money, according to the New York Times. That amount includes $120 million in refunds to people who were scammed out of their money via Cash App.

While fraudsters are sneaky and often convincing, Cash App scams also tend to share common traits that make them easier to spot.

“Consumers flocked to Cash App because it was easy to use and convenient, but unfortunately, the scammers quickly followed suit,” says Alex Hamerstone, advisory solutions director at cybersecurity company TrustedSec. “It is vital for consumers to educate themselves on the tricks and techniques scammers are using and be on the lookout for potential red flags.”

Keep reading to learn the risks of using Cash App and how to avoid the common Cash App scams that could leave your information and money vulnerable to criminals.

Get Reader’s Digest’s Read Up newsletter for more tech, humor, cleaning, travel and fun facts all week long.

On This Page

Is Cash App safe?

In most cases, Cash App is a safe and convenient way to transfer money to friends, family members and businesses. “Cash App is not inherently more or less safe than other legitimate peer-to-peer payment apps, such as Venmo and Zelle,” says Eva Velasquez, president and CEO of Identity Theft Resource Center.

Cash App even offers several security features that other payment apps do not, including an artificial intelligence–driven function that flags potential scams, text messages alerting customers of an unusual login attempt and a prompt requiring users to confirm a money transfer to someone who is not on their contact list. Rest assured that there is nothing wrong with using Cash App to transfer cash in a pinch, especially for the times when you shouldn’t use your credit card for payment.

Risks of using Cash App

The tool offers safety precautions to protect its customers, but is Cash App safe? “How users engage with the technology can make all the difference,” Velasquez says. Scammers often take advantage of people who use Cash App like a bank, by storing money on the app, or who are willing to transfer money to strangers.

What’s more, transfers through Cash App are not protected in the case of fraud or theft, unlike payments made using a traditional credit or debit card. Since Cash App treats all money like cash, it’s almost impossible to get the money back once it is transferred.

In other words, if you’re going to use Cash App, learn how to spot these prevalent Cash App scams before you lose money. In fact, no matter what contactless payment app you use—Apple Pay and Google Pay are also vulnerable to scams—be sure you know how to spot scams before you send a payment.

The most common Cash App scams

No matter how often you use Cash App, do yourself a favor and learn about the scams you may come across on the app. It could save you a good chunk of change in the end.

1. Impersonating customer support

Cash App does not offer live customer support and encourages users to report any issues, including fraud and scams, through the app instead. But many Cash App users have been fooled by scammers who impersonate Cash App customer service employees through phone scams.

These thieves create phony websites with fake Cash App support phone numbers, which victims believe are real when they appear in a Google search. When victims call the phone number, the fraudster pretends to be a Cash App representative and asks them for their login information. These bad actors will later use the login details to hijack the account and make purchases.

“Scammers are incorporating AI-generated phishing emails, messages, and voice cloning, which have really upped the game and made them even more convincing,” says Scott Schober, CEO of cybersecurity firm Berkeley Varitronics Systems and author of Hacked Again.

How to avoid it: When you call customer support, beware of anyone who asks for personal information, such as your Cash App PIN or sign-in code. “Cash App Support will never ask you to provide your sign-in code, PIN, or other sensitive information like your full bank account information. Cash Support will never require you to send a payment, make a purchase, download any application for ‘remote access, or complete a ‘test’ transaction of any kind,” according to Cash App’s website.

Adam Gordon, an advanced security practitioner, security architect and consultant, recommends going straight to Cash App’s website to find the customer support phone number or reporting the issue through the app instead. That way, you can avoid accidentally stumbling upon a fake Cash App customer service number.

2. Selling expensive items through Cash App

Expensive payment or deposit scams typically lure you in by dangling high-value items at costs that are below their market value, says Seth Ruden, a certified fraud examiner and global advisory director for the U.S. and Canada at BioCatch, a cybersecurity company specializing in digital fraud prevention. The bait could look like a gorgeous rental, purebred pup, or sold-out concert tickets.

Although the urge to snag a deal is understandable, you should never agree to put down a deposit or pay for expensive items via Cash App. Scammers know that Cash App doesn’t provide buyer protection, so they are more likely to ask their victims to use the app to pay for fake items sold on online shopping platforms like Facebook Marketplace or OfferUp. Once the unsuspecting users pay the fees, the fraudsters will disappear without handing over the items.

How to avoid it: “You should always be able to inspect the goods before making a deposit, and any pressure or excuse to neglect your own due diligence should be a strong indicator that this is likely a scam,” says Ruden. If you can’t verify whatever you want to purchase is legitimate or see it in person, it’s not worth the risk—walk away.

If you think you’ve been scammed on Cash App, you can dispute the charge through the app by following the steps below.

- Go to your Activity page.

- Tap on the transaction.

- Tap “Report an issue.”

- Tap “I was scammed.”

- Follow the prompts to share more details.

The Cash App team will investigate your claim, but there is no guarantee you will get your money back, Gordon says. Your money will be safest if you limit your transactions to your close friends and family members or carry a few bucks in your wallet for the times when it’s better to pay in cash.

3. Sending random payments

We know what you’re thinking: “A random person sent me money on Cash App—score!” But while receiving an unexpected payment might feel like a pleasant surprise at first, it’s likely “the bait for a scam,” Hamerstone says.

Here’s how it works: Fraudsters create a fake profile, link it to a stolen credit card or bank account number and “accidentally” send a fake Cash App payment to a random victim. Next, they contact the recipient through the app’s messaging feature and ask the victim to send it back. Meanwhile, they switch the stolen card in their CashApp profile to their own card and collect the refund.

But the scammers don’t stop there. They then contact the issuer of the stolen credit card to dispute the charge, and they get the money back—again. Then the stolen card is canceled—either by the scammers or by the card issuer once it discovers the fraud—and the stolen funds disappear from your account, leaving you on the hook for the amount you refunded.

How to avoid it: If you receive an unexpected or random payment, resist the urge to contact the sender yourself. “While you can ask the sender to cancel the payment, this can sometimes lead you down a rabbit hole of back-and-forth interactions,” Hamerstone says. Instead, he recommends blocking the user, then reporting the issue to Cash App’s customer service department and asking them to cancel the payment.

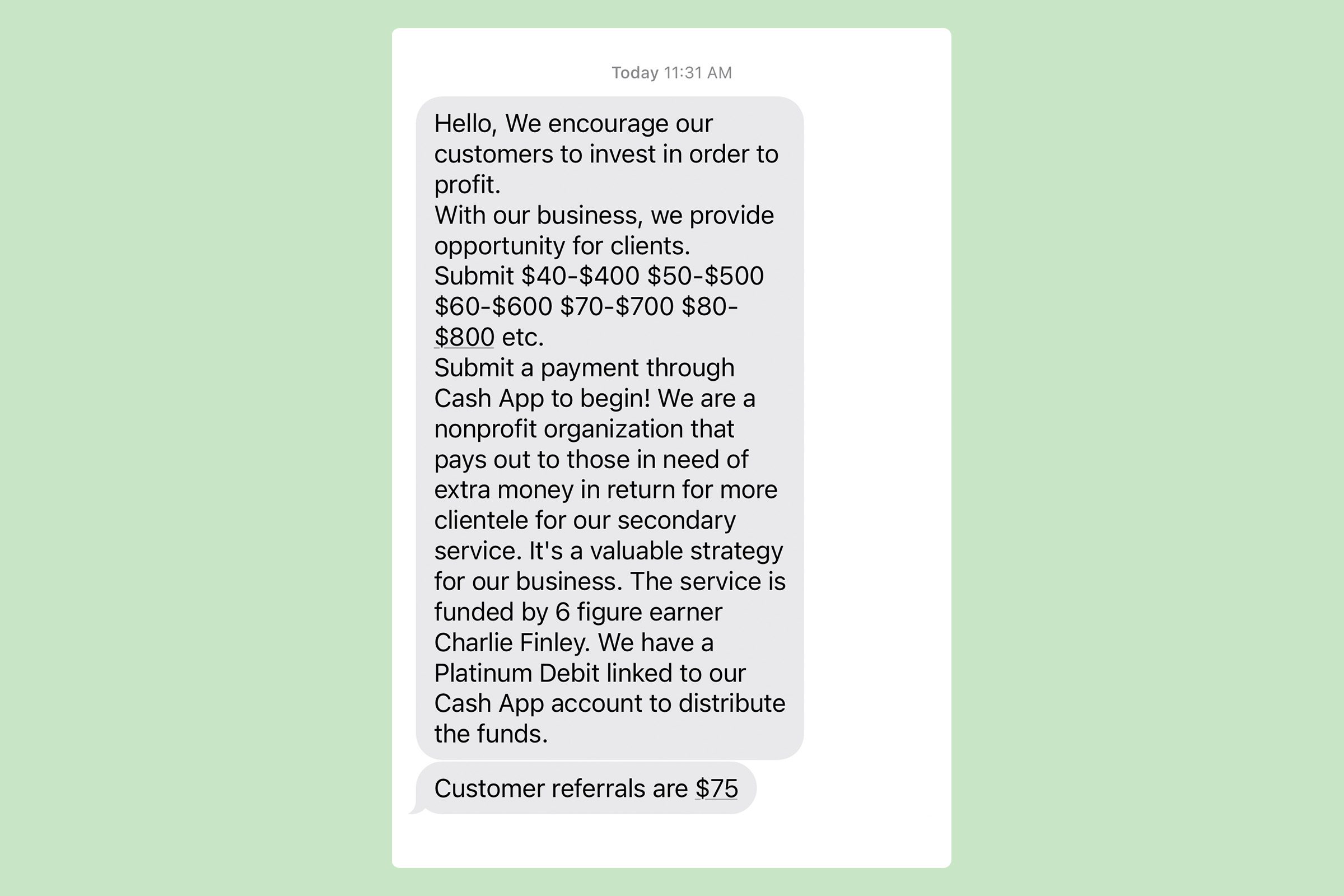

4. Cash flipping

There is one rule of thumb when it comes to Cash App scams: If it seems too good to be true, it probably is, according to Gordon. For example, in a scam popular on social media, fraudsters promise to increase (or “flip”) your money when you send them money via Cash App first. If you send them $10 to $1,000, they claim, they will send you back double or triple the original sum. (Spoiler: They won’t.)

In another common Cash App scam, bad actors will ask you to send a certain amount of money in return for a higher rate, which you’ll supposedly receive from other participants. Called a money circle, cash wheel or pyramid scheme, these scams are designed so that you never receive any money back.

How to avoid it: To avoid getting tricked by one of these scams, “your first line of defense is to not send money to people you do not know,” Gordon says. Keep your transactions only between people you know and trust—no matter how good a deal it seems.

5. App glitch scams

Cash App notes that scammers will sometimes send messages to users claiming that there is a glitch in the software, and urging them to download an updated version. The scammers provide a link, but instead of going to the App Store or Google Play, the link takes victims to a malicious website. When the targets “log in,” the site steals their credentials and takes control of their account.

How to avoid it: Never enter login credentials on a site you clicked a link to visit. Instead, visit the site directly by typing the URL into your browser. You can also check the validity of a link by hovering over it (instead of clicking) with your cursor. This will reveal the full URL associated with the link. You can also reach out directly to Cash App to inquire about any reported glitch.

6. Fake #CashAppFriday offers

Cash App used to hold an official sweepstakes in which customers could win cash prizes every Friday. While Cash App no longer does #CashAppFriday, scammers continue to post fake Cash App events on Instagram, Facebook and other social networks with hashtags like #CashAppFriday and #CashAppGiveaway. They will create fraudulent raffles, then message users, asking them to transfer a few dollars via Cash App or share their login credentials for a chance to win. Users may send the money or info, but they never win anything in return.

How to avoid it: Never take a random sweepstakes offer on social media at face value, and always confirm it’s legitimate by checking that it’s coming from the official company account, says Gordon. If you want to participate in real Cash App giveaways, follow Cash App on X and Instagram (@CashApp).

7. Data breach scams

In this type of scam, fraudsters send users a message saying that Cash App has experienced a data breach—something that can trigger panic in even the savviest of consumers. The scammers tell their victim that they need to take action no to protect their account. To do so, they need to click on a link, which—you guessed it—steals login credentials, financial information, or other personal data.

What makes this scam particularly easy to fall for is that Cash App did have data breaches, revealed in 2022 and 2023, that affected millions of users and resulted in a $15 million settlement, according to the New York Times.

How to avoid it: If there were a legitimate data breach, reputable news outlets would be carrying information about it. And again, never click on a link in an unsolicited email or text; instead, go directly to a company’s official website to learn more.

8. Offering investment opportunities

With more and more people getting interested in cryptocurrency, scammers have taken note. These bad guys fool victims by approaching them with an unbelievable opportunity to invest in crypto. Once victims send funds to purchase the cryptocurrency through Cash App, the scammer will disappear with the money.

In other scenarios, the scammer sends the victim back the money, plus some extra cash that they “earned” from the investment to entice them to send more. “This can go on and on until the scammer cleans you out or you eventually realize the scam,” Hamerstone says. “But either way, the money is gone, and you are left with little recourse to get it back.”

How to avoid it: Be skeptical of strangers on Cash App who approach you with an investment opportunity. “As with many scams, these often begin with a too-good-to-be-true opportunity, which is a red flag that something is wrong,” Hamerstone says. You should only use Cash App to exchange money with people you know and trust.

He also recommends blocking users who contact you randomly. “While it may seem random to you, the scammer knows exactly what they are doing,” he says.

9. Hacking accounts

Scammers can’t steal your money just by finding your Cash App name, but they could potentially hijack the account if you don’t follow proper password security. If you reuse a password for multiple accounts, for example, hackers can find it by purchasing password lists on the dark web and running the passwords against a variety of online accounts, Hamerstone says.

How to avoid it: To protect your Cash App account from hackers, create a strong, unique password and enable two-factor authentication. Do the same for your email account, which is likely to have access to sensitive information or accounts. Above all, it’s important to never share your login credentials, two-factor authentication code or password reset links with anyone—and be skeptical of people who ask for them.

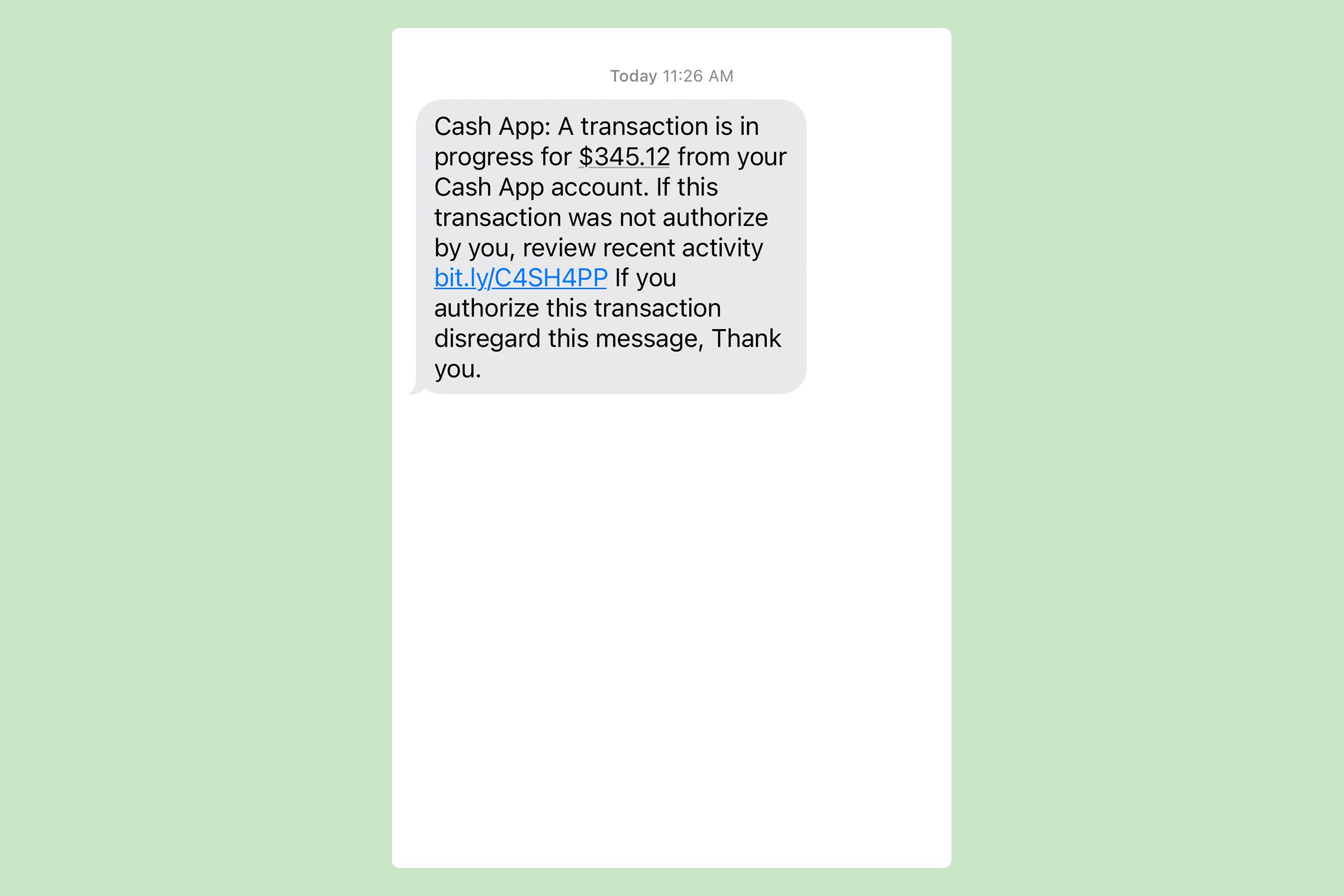

10. Smishing texts

Like phishing emails, the scam called smishing—short for SMS plus phishing—is a form of social engineering that tries to trick you out of personal information. Victims of this scam receive texts that appear to be from Cash App at first glance. But in reality, a fraudster is behind the phony message.

The texts may ask you to verify your Cash App account or tell you to change your password because your account was compromised. They include a link to a fake site that steals your username and password when you try to log in. Once scammers know your login credentials, they can gain access to your account and request money from your friends or purchase items with your card.

How to avoid it: Never click on any links sent via an unsolicited text, email or social media message, even if it looks like it came from a legitimate source like Cash App, Hamerstone says. To secure your account from hackers who have your login credentials, he suggests turning on two-factor authentication and using the Security Lock setting in Cash App, which requires a passcode when making a payment. It’s also good practice to avoid storing money in your Cash App account in case it gets hacked, Hamerstone says.

11. Romance scams

Most romance scammer stories begin the same way: The scammer courts the victim on a dating app or through social media and wins their trust with tactics like love bombing. After a few weeks or months, they tell the victim that they need money for a made-up emergency and ask the victim to transfer the money using Cash App.

“Victims are usually asked for more and more until, like with other scams, you are left with nothing or are ghosted by your ‘boyfriend/girlfriend’ and learn that they are no longer online,” Hamerstone says.

How to avoid it: First and foremost, it’s best to limit the personal information you share with people you meet online. Once they gain your trust, “scammers are banking on your emotions taking over your judgment,” Hamerstone says. This makes you more vulnerable to their tricks.

You should also never send money or share your Social Security number or bank account information with people online. Not only are requests for these items a sign of romance scams, but they could also leave you vulnerable to bank scams.

12. Phony disaster programs

The coronavirus pandemic was a boon for cybercriminals looking to swindle Cash App users out of money. In fact, complaints of fraud on Cash App increased a whopping 472% during the pandemic, according to the Federal Trade Commission.

When disaster strikes, some fraudsters create fake grant or relief programs that ask for payment or advanced fees to receive benefits. Others advertise phony lottery or giveaway scams that claim you’ve won a prize for being vaccinated, Velasquez says.

How to avoid it: “It sounds plausible because there are legitimate lotteries in several states,” Velasquez says, but there is one major red flag: These scammers will ask for identity credentials and financial information, and they’ll request that you pay taxes or fees upfront.

If an offer seems fishy, Velasquez suggests confirming with the organization through their official phone number. Think twice before providing personal account information to someone claiming to be a state or federal government employee.

13. Loan scams

You could be vulnerable to loan scams if you’re in a bad financial situation and desperate for cash. How it works: A potential “lender” sends you an unsolicited message offering to help you secure a loan that you automatically qualify for—you just have to pay a fee via Cash App first. The scammer might ask for personal information to get more out of you or just disappear with your money.

How to avoid it: “Avoiding any kind of get-cash-quick scam goes back to the same-old advice: If it’s too good to be true, it’s too good to be true,” says Schoeber. Do not make any major financial decisions over the internet with a mysterious stranger.

Will Cash App refund your money if you’ve been scammed?

It’s unlikely, though acting quickly enhances your chances of recovering your money. You may be able to get a refund in a few specific circumstances:

- You cancel a payment in the app before it goes through to the recipient.

- The “scam” was actually an honest mistake. In this case, you can go to the activity tab in the app and request a refund directly from the person you sent the money to.

- Dispute the transaction with the Cash App support team. Again, use the activity tab to find the specific transaction and click “Cash App support,” and then “Dispute this transaction.” The support team will investigate your claim, and let you know of their decision.

What else should you do if you’ve been scammed?

If you think you’re a victim of a Cash App scam, immediately report the incident to Cash Support and cut off contact with the scammer, according to Cash App’s website. It’s also a good idea to turn on notifications to monitor activity on your account.

Velasquez suggests alerting the Federal Trade Commission and Internet Crime Complaint Center if you lost money. The FTC gathers data about scams to spot patterns, find the people behind them, and take legal action. When you report a scam, you help fight fraud and protect others too.

Immediately change your Cash App account password. To protect your account going forward, choose a unique passphrase, use a different password for each online account and save all passwords in a password manager.

How to avoid Cash App scams

Following these security tips can help protect you from the most common Cash App scams.

- Be alert to the biggest signs of payment scams. Get-rich-quick schemes, deals that are too good to be true, a false sense of urgency, typos, and unexpected text messages or calls are all red flags you cannot ignore.

- Only send money to people you know and trust. Avoid transactions with strangers unless they are trusted sellers with a strong track record and reviews.

- Confirm purchases in person. Before putting down a deposit on a rental or pet, meet the seller to take a look in real life.

- Secure your Cash App account. Create layers of security with features like notifications to keep track of purchases, two-factor authentication, and Security Lock, which requires a PIN, touch ID, or face ID for all transactions.

- Don’t send out personal information. No one needs your PIN, sign-in code, Social Security number, or other pieces of sensitive information—unless they plan to sell them on the dark web.

- Only use official communication channels. Stick with in-app conversations or connect with Cash App customer service through their official website or phone number. Avoid clicking links or responding to unsolicited texts or calls.

Remember: Sending money through Cash App is just like handing someone cash—once it’s gone, it’s gone.

About the experts

|

Why trust us

Reader’s Digest has published hundreds of articles on personal technology, arming readers with the knowledge to protect themselves against cybersecurity threats and internet scams as well as revealing the best tips, tricks and shortcuts for computers, cellphones, apps, texting, social media and more. For this piece, Brooke Nelson Alexander tapped her experience as longtime journalists and tech reporter. We rely on credentialed experts with personal experience and know-how as well as primary sources including tech companies, professional organizations and academic institutions. We verify all facts and data and revisit them over time to ensure they remain accurate and up to date. Read more about our team, our contributors and our editorial policies.

Sources:

- New York Times: “Cash App Ordered to Pay $255 Million in Penalties Over Fraud”

- Alex Hamerstone, CISSP, advisory solutions director at TrustedSec

- Eva Velasquez, president and CEO of Identity Theft Resource Center

- Scott Schober, CEO of cybersecurity firm Berkeley Varitronics Systems and author of Hacked Again

- Adam Gordon, an advanced security practitioner, security architect and consultant,

- Seth Ruden, certified fraud examiner and global advisory director for the U.S. and Canada at BioCatch

- New York Times, “Cash App Users May Claim Up to $2,500 in Data Breach Settlement:

- Cash App: “Recognize Scams and Keep Your Money Safe with Cash App”

- Cash App: “Recovering from a Scam: What Comes Next?”

- Federal Trade Commission: “Report to help fight fraud!”

- Internet Crime Complaint Center: “Welcome to the Internet Crime Complaint Center”